what is a quarterly tax provision

Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. Recent editions appear below.

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Calculate the quarterly tax provision c.

. The deferred tax calculation which focuses on the effects of temporary differences and other tax attributes over. Quarterly Return of Council Taxes National Non-Domestic Rates NNDR Localised Council Tax Support LCTS. Some taxpayers instantly qualify.

Tax provisions are only one kind of provision. Example 1 No Discrete Items Calculate the quarterly tax provision and the ETR for the quarter. A tax rate is generated at the beginning of the year for summary periods such as Quarterly or Yearly.

Calculate the quarter effective tax rate Q1 Q2 Q3 Q4 Projected full-year AETR 40 35 37 35 Quarterly book income 400 100 200 700 YTD book income 400 500 300 1000. Yes Im studying AUD right now the company estimates their taxable income for the year and every quarter you adjust the provision to correct what was. CrossBorder Solutions Senior Tax Manager Howard Telson breaks down the differences between preparing the quarterly provision 10-Q and the annual provision 10-Kand how each communicates to stakeholders about the financial health of a company.

This issue discusses several important developments and related ASC 740 considerations. Topics covered in this edition. It is typically appropriate to record an investors equity in the net income of a 50 or-less owned investee on an after-tax basis ie the investee would provide taxes in its financial statements based on its own estimated annual ETR calculation.

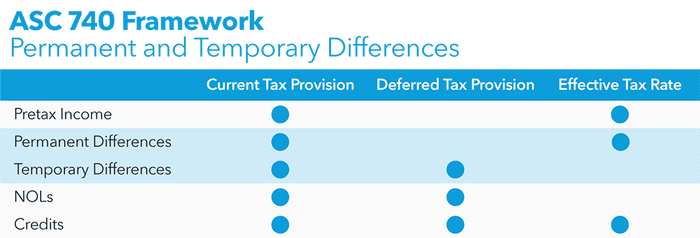

Quarterly Hot Topics is now available. A companys current tax expense is based upon current earnings and the current years permanent and temporary differences. Typically this is represented quarterly with each earnings.

The third quarter is due on September 15. We begin with an overview of how to calculate a quarterly income tax provision including how to estimate the annual effective tax rate AETR. Income tax provisions determined under the general recognition and measurement requirements for accounting for income taxes as per ASC 740-10 The estimated ETR includes the anticipated effect of income tax credits and.

The corporate income tax provision is an important and complex component of the financial statements and related disclosures and it is receiving ever-increasing scrutiny due to its significance to the operating statement. The provision is always calculated on a year-to-date basis no matter how frequently it is calculated. You do quarterly reviews less substantial in scope than an audit.

16343 Interim provisionincome from equity method investments. The latest issue of Accounting for Income Taxes. After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports.

Interim Tax Provisioning Overview. Based on the profit before tax calculated above the tax provision amount will be 12000 40000 x 03 Journal entry will be following. Provision for income tax ac.

Profit or loss ac. The IRS expects tax payments to be made quarterly to cover income thats been made in the previous three months. Depending on the industry a business might also create provisions for bad debts depreciation pensions sales allowances and more.

WASHINGTON Taxpayers requesting an extension will have until Monday Oct. Tax rate changes in the quarter in which the law is effective. Current income tax expense and deferred income tax expense.

In the income statement it will be reported as following. An Administrator or Power User can also create interim tax periods for example monthly or non-year end to estimate the current and deferred taxes for the interim period based on the Annualized Estimated Effective Tax Rate AEETR. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. The provision is the audit part of tax. The provision can be calculated on a monthly quarterly or annual basis as required.

A tax provision is comprised of two parts. The first quarter is due on April 15. In normal years these are the due dates.

17 2022 to file a return. 739 - Ordinary income. Other types of provisions a business typically accounts for include bad debts depreciation product.

A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense. In recent years tax-related issues have been a primary reason for restating financial statements and accounting for. The amount of this provision is derived by adjusting the firms reported net income with a variety of permanent differences and temporary differences.

Annual ETR applied to YTD income plus discreet tax items make up the quarterly annual tax expense. Disaster victims taxpayers serving in combat zones and those living abroad automatically have longer to file. Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the forecast annual ETR smoothes the tax impact over the full year.

Not everyone has to ask for more time however. Quarterly Estimated Tax Periods means the two three and four calendar month periods with respect to which Federal quarterly estimated tax payments are made. Quarterly Tax Payments Throughout the Year.

The adjusted net income figure is then multiplied by the applicable. Its an estimation of your current years tax burden that is set aside until the payment comes due. Second quarter payments are due on June 15.

A tax provision safeguards your business from paying penalties and interest on late taxes. The first such period begins on January 1 and ends on March 31. What does ordinary income mean in the context of your interim tax provision.

Extensions of time to file tax returns. It is important that you read this note before completing your QRC4 form.

Income And Expense Statement Template Personal Financial Statement Financial Plan Template Financial Statement

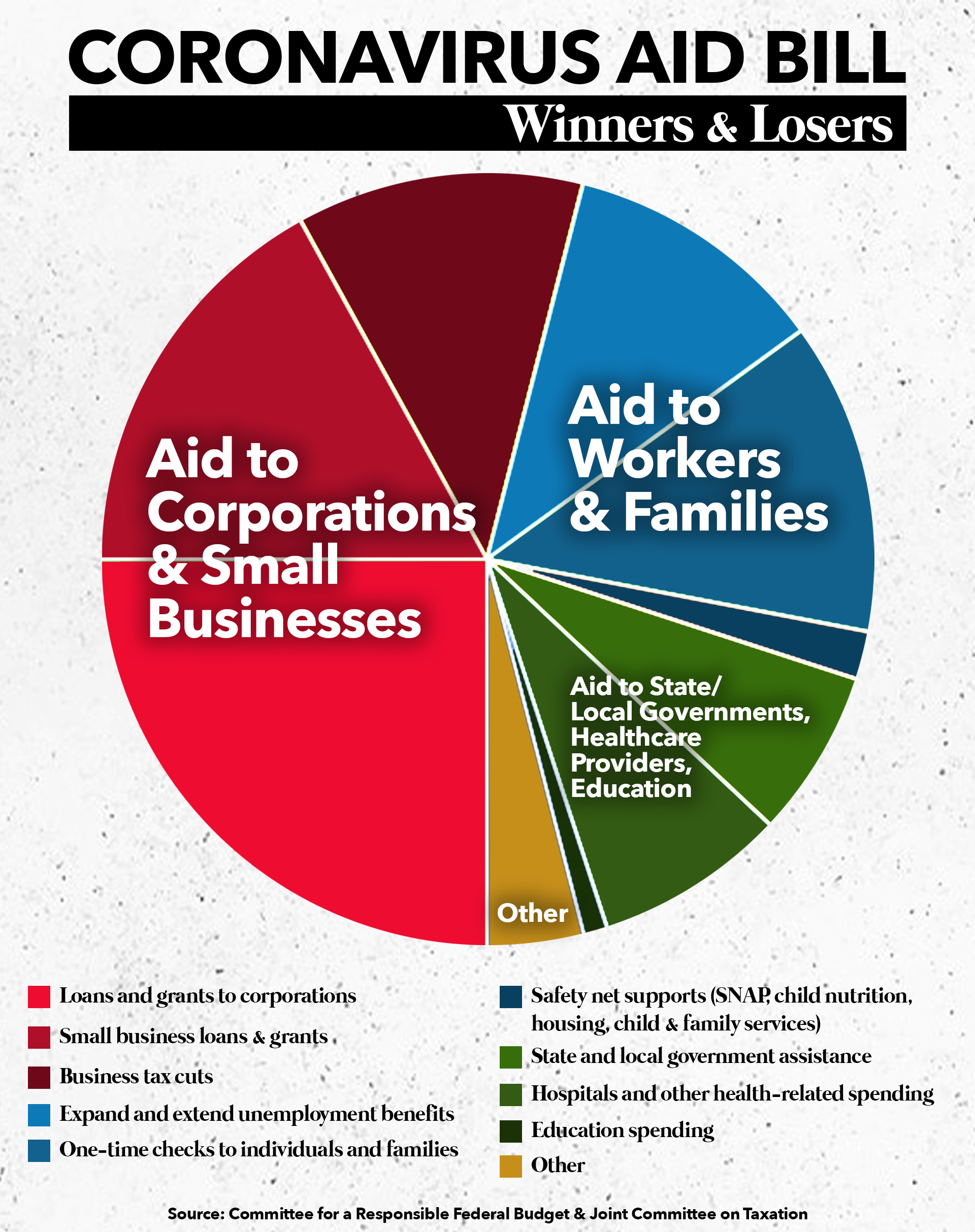

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness

Apc Distributor Rebate Agreement Intended For Volume Rebate Agreement Template 10 Professional Templates Ideas Professional Templates Templates Agreement

Car Donation Tax Deduction Simplified Http Www Irstaxapp Com Car Donation Tax Deduction Simplified Donate Car Donation Tax Deduction Tax Credits

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Provision For Income Tax Definition Formula Calculation Examples

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Gstr 1 Due Date October December 2020 Goods And Service Tax Goods And Services Udemy Coupon

425 02 Chartered Accountant Mumbai Chartered Accountant Job Hunting Job Posting

Goodwill Donation Values Spreadsheet Personal Financial Statement Financial Statement Statement Template

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

For Small Assesses Compliance With Indian Tax Laws Has Always Been A Challenge Forcing Such Assesses For Compliance May Not Yiel State Tax Schemes Composition

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Gstr 3b July 2017 To Sept 2017 Unilateral Rectification Invalid Tax Income Tax Tax Exemption

Purchase Management Icons Business Icon Business Icons Vector Management

How To Make Gst Tax Liability Payment In 2021 Liability Business Updates Business Advisor